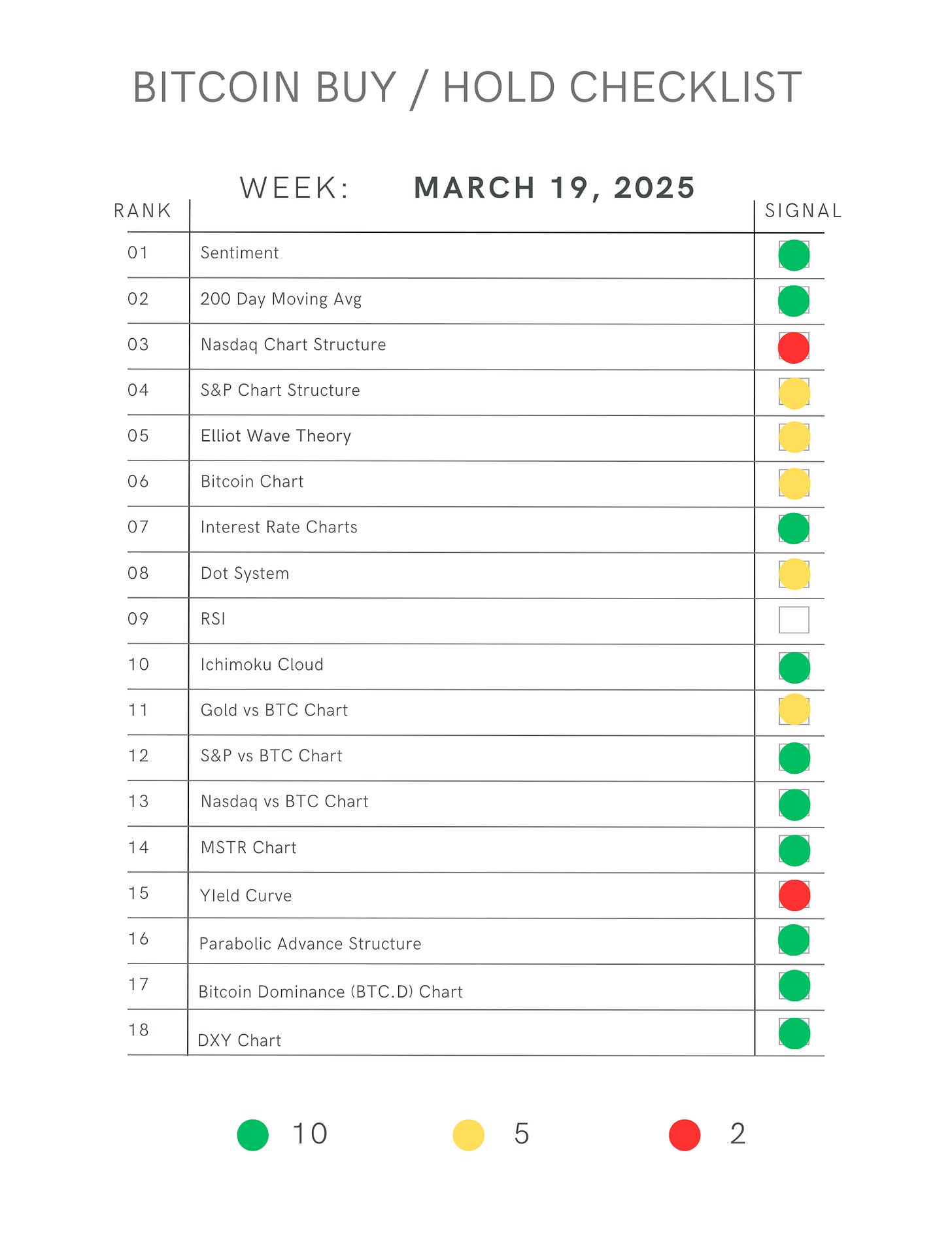

Bitcoin Check List - March 19, 2025

The check list hasn’t changed much in the last two weeks.

Here’s what has changed:

Nasdaq chart structure has broken its trend from the November 2022 bottom. The S&P chart structure is still in tact and the Nasdaq chart could regain it’s structure. With the FED meeting earlier today, we could definitely see that happening in the next week or two.

I turned the MSTR Chart signal from Red to Green. MSTR has seen a 56% drop from the top. And now it’s recovering and could even be breaking out of a bull flag pattern. MSTR has the potential to reach back up to all time highs if we see Bitcoin back above $100k. The MSTR chart is no longer a red flag.

We really need to see BTC.D start to break down. It looks like it’s topped out, but a break down would be a huge Green signal.

Summary

Overall the market hates uncertainty and with Trump’s tariff threats, it caused a lot of uncertainty. But there’s a chance things start to clear up. These tariff threats might get resolved, there are peace talks right now between Ukraine, and Russia. Plus the FED announced that they are reducing QT (quantitative tightening) which could also put the wind in the market’s sails.

Here’s my projection:

Based on sentiment, everyone is preparing for a recession and market crash. But instead of a crash, the markets (crypto, S&P, Nasdaq) rally again to all time highs. This gets everyone convinced that markets can dip, but will always rally back.

It’s at this point when everyone is convinced that every dip will be bought up when things finally top out.

A couple things that make me think the market hasn’t peaked yet is AI. AI is allowing for production like we’ve never seen before. I think AI will reach a fever pitch and this too will mark the top.

What to Look For

If you want signs of a top to look for, here’s what to expect:

Fed Chair, Jerome Powell, to be on the cover of a magazine that says “Soft Landing Accomplished”

Trump tweeting about how great the stock market is

You can’t anywhere without hearing about AI. It will be on the TV, your friends and family will be talking about it and NVDA will be back to all time highs

Bitcoin or Ethereum will be trending and everyone will be talking about $200k Bitcoin and $10k for Ethereum.

I don’t think we’ve topped yet, but let’s see how we finish March!